precedent-setting Money Laundering Investigations

As Featured By

A new age for crime

Money launders are highly-skilled and experienced individuals who operate across various countries and jurisdictions. They often design intricate networks comprised of shell companies, corrupt officials and fellow fraudsters.

New tools emerge everyday to enhance their operations and take advantage of the fragmented international anti-money laundering (AML) landscape. To identify, capture and recover funds requires a company with experience in law, crime and international fraud.

Warden Consulting has experience assisting financial institutions, local authorities and global MNCs in combating all types of money laundering operations. Our global network of investigators, financial accountants, intelligence agencies and law enforcement officers combine to unveil international money laundering operations.

We cater to financial institutions, state authorities and victims of financial crime.

-

40+ Years Experience

-

Over $70 million recovered

-

Operations in over 25 countries

-

40+ Arrests

Ready to resolve your issue?

-

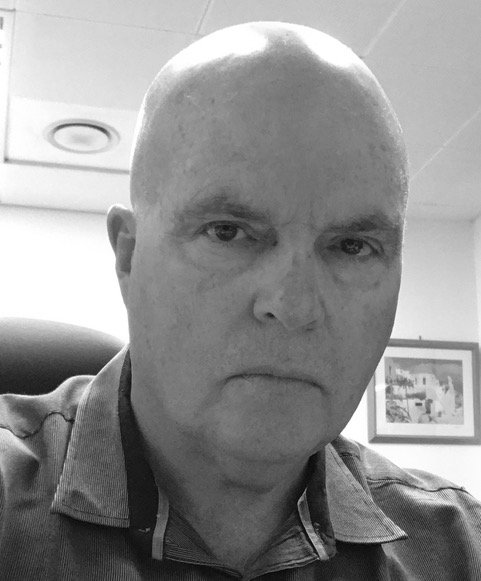

Mark van Leewarden

Founder & MD

Mark was deployed as an undercover agent at age 20. He quickly infiltrated an organized crime operation and became a running mate with one of New Zealand's most notorious criminals. Mark would go on to earn honours degree in Law before founding Warden Consulting in 1995. Working across all aspects of the business, he has traced, frozen and distributed stolen assets back to our clients in Asia, Europe and The Americas. He is enrolled as a barrister and solicitor of the High Court Of New Zealand and holds a practicing certificate as a barrister.

-

Ben van Leewarden

General Manager

Ben is a licensed private investigator with over eight years experience in international fraud, surveillance and undercover operations. Ben brings true international experience to the company having operated the business in Amsterdam, New York, London and Mexico City. He holds a Bachelor of Commerce (BCom) degree from Victoria University in Wellington.

-

Dennis Parsons

Consultant

Dennis is an expert forensic accountant, certified fraud examiner (USA), and licensed insolvency practitioner (NZ) who has undertaken hundreds of forensic accounting investigations of companies and individuals in both civil and criminal cases. He provides expert advice and consultation services to a number of government agencies in relation to civil and criminal investigations and related regulatory matters.

-

Pablo Rivera

Legal Counsel

Pablo holds a masters degree in Law (LL.M.) from La Universidad Nacional Autónoma de México (UNAM). A specialist in corporate law he has worked for Google, Baker Hughes, McDonalds and Jaguar. He assists on financial crime cases and provides specialised legal investigation advice from our Mexico City office.

-

Andrea Tomba

Consultant

Andrea holds a BA (Hons) in Business Studies from the University of Westminster. He is fluent in Italian, French, Swedish, English, and Spanish. He has lived in Mexico for the last 25 years. Andrea's diverse skill set and global perspective are key assets for international cases.

-

Ainsley Bisset

Operations

Ainsley ("Ladybird"), started her career in the Police. She was a member of the Diplomatic Protection Squad, protecting high profile dignitaries and politicians including Princess Diana. Ainsley oversees all major fraud cases, conducting research and organizing backend logistics. She has HR responsibility including the protection and care of Warden undercover agents.

-

Denise Graham

Office Manager

Denise ("Diesel") is our Office Manager and has been with Warden since 2006. She manages each and every detail of our day-to-day business. Diesel came to us following a long and varied career in the legal sectors, commencing work at the Magistrates Court in Auckland and subsequently working for Barristers, Queen’s Counsel and law firms in New Zealand, Australia and the UK.

-

Warden’s Network

International Associates

Our international team of lawyers, forensic accountants, investigators, finance executives, covert agents and government agency officials work together to deliver the most desirable outcome.

what is money laundering?

Money laundering is the act by which proceeds of crime are made to appear legitimate. Often, criminals move quickly to transfer illicit funds across different financial systems and jurisdictions. New tools, such as virtual currencies, favour anonymity and make it difficult to trace funds back to their original source.

Our Money Laundering Recovery Process

1. Detection and Analysis

We begin by analysing financial transactions, records, and patterns to identify the predicate offense(s) and potential money laundering activities. Our investigators meticulously sift through data to uncover anomalies and suspicious activities.

2. Tracing the Flow of Funds

Once suspicious activities are identified, our forensic accountants follow the money trail, navigating through complex transactions and global pathways.

3. Identifying Assets

Through in-depth analysis, we pinpoint the assets that have been illegally acquired or transferred as a result of money laundering. This step involves a thorough examination of financial records, digital footprints, and ownership structures.

4. Legal Collaboration

On international cases our barristers collaborate with local legal experts to align our actions with local laws and regulations.

5. Negotiation and Recovery

In cases where negotiations are possible, we engage with relevant parties to negotiate the return of assets.

6. Asset Distribution

Once recovered, we guide the process of repatriating the assets to our clients' possession. We ensure that the assets are returned through proper legal channels and in compliance with all necessary regulations.

Learn More About Warden

Stages of money laundering

Placement: The initial stage involves introducing "dirty" money into the financial system. This can be done by depositing cash into banks, purchasing assets, or engaging in transactions that mix the illegal funds with legitimate ones.

Layering: In this stage, complex transactions are conducted to confuse the audit trail. Funds are moved between various accounts, converted into different forms, and transferred across jurisdictions to make tracing difficult.

Integration: At this stage, the "cleaned" funds are reintroduced into the legitimate economy. They may be invested in legal businesses, real estate, or other assets, making it appear as though they were acquired through legal means.

Types of Money Laundering Operations

Structuring or Smurfing: This involves breaking large amounts of money into smaller, less suspicious transactions to avoid reporting requirements.

Trade-Based Money Laundering: Criminals manipulate trade transactions to move funds across borders. They might overvalue or undervalue goods or services to move money between legitimate and illegitimate entities.

Real Estate Laundering: Criminals buy real estate using illicit funds, making it difficult to trace the origin of the money.

Virtual Currencies: Cryptocurrencies can be used to launder money due to their pseudonymous nature and ease of transfer across borders.

Offshore Accounts: Funds are moved to countries with lax financial regulations and secrecy laws, making it hard to trace ownership.

How criminals evade detection and Arrest

Shell Companies:

Shell companies play a pivotal role in the money laundering process. These are businesses that exist primarily on paper, lacking genuine business operations or significant assets. Fraudsters establish multiple layers of shell companies to create complex webs of ownership and financial transactions, making it challenging for authorities to unravel the true beneficiaries and origins of funds.

Identity Theft and “Straw Men”

Fraudsters recruit individuals, often referred to as "straw men," to act as proxies for their activities. These individuals may lend their names and identities to open bank accounts, register companies, or execute transactions on behalf of the fraudsters. By using these intermediaries, fraudsters create another layer of separation between themselves and their illegal activities.

Layering and Complex Transactions

Fraudsters engage in layering—a process where funds are moved through multiple transactions across different accounts and jurisdictions. This layering obscures the audit trail, making it difficult to trace the money back to its illicit source.

International Jurisdiction Hopping

Fraudsters move their operations across countries with varying degrees of regulatory enforcement, making it challenging for law enforcement to pursue them. Fraudsters exploit the discrepancies in international regulations and enforcement to their advantage. They establish operations in countries with weak financial oversight, allowing them to bypass stringent due diligence and reporting requirements.

Smurfing Across Borders

Frauds involving small transactions in multiple countries make detection difficult due to the sheer volume and geographical dispersion.

Digital and Cyber Strategies

Online fraudsters use anonymizing tools, virtual private networks (VPNs), and cryptocurrencies to obfuscate their identity and evade tracking

Corruption and Bribery

Fraudsters may exploit corrupt officials or institutions in different countries to facilitate their operations.

AML

AML compliance is an essential task in the futureproofing of your business.

By detecting and deterring money laundering, we can disrupt the funding of activities such as drug trafficking, terrorism, and corruption. Here's how we assist businesses with AML:

Customer Due Diligence (CDD)

Thoroughly verifying the identity of customers and assessing their risk profiles. This helps in identifying high-risk individuals or entities that might be involved in money laundering.

Improving Transaction Monitoring

Regularly reviewing financial transactions for unusual patterns or activities that could indicate money laundering. Rapid identification of suspicious transactions is a key component of AML.

Reporting Suspicious Activities

Promptly reporting any suspicious financial activities to the relevant authorities is vital. This collaborative effort between financial institutions and law enforcement helps prevent and combat money laundering.

Employee Training

Educating employees about AML regulations, red flags, and their role in preventing money laundering is essential for creating a vigilant environment.