The world's LEADING fraud investigator

_Cross-Border covert, legal and strategic solutions

As Featured By

A hybrid of investigating lawyers, former law ENFORCEMENT and fraud experts.

We combine these essential disciplines to get results that would otherwise be unachievable.

Fraudsters are exploiting globalized monetary systems.

Warden works seamlessly across borders to dismantle international fraud schemes. We align professional skills to achieve a common goal: accountability and recovering our clients stolen assets.

-

40+ Years Experience

-

Over $70 million recovered

-

Operations in over 25 countries

-

40+ Arrests

tying it all together

There is no overarching international body that investigates or recovers stolen funds spread across multiple jurisdictions. Our international network of investigators, forensic accountants, lawyers and compliance experts resolve the world’s most complex fraud schemes.

Warden Consulting is a certified financial crimes investigator resolving international money laundering operations, employee theft and fraud, cybercrime as well as corporate and securities breaches.

Case Studies

First Equity Enterprises - BOILER ROOM FRAUD

This fraud investigation involved the representation of 322 clients from 30 countries in respect of the loss of USD $100 million. The funds were lost as a result of a Russian organised crime fraud operation based in New York. Warden froze funds in a BNP Paribas account in Geneva through a private Seizure Order. It was subsequently established this account contained $4.7 million and that the following day one of the offenders in the boiler room (Gary Faberov) attempted to shift these funds from the account. In the absence of the Seizure Order, Mr Faberov would have been successful. In total Warden recovered over $10 million.

Investors Hold Bank Liable for Losses at Currency Firm — New York Times

$100m Fraud Probe Linked To Terror Attack — The Guardian

SHERIDAN LESLIE COX - MENDES PRIOR FRAUD

We represented New Zealand and worldwide groups concerning the fraud offending of Sheridan Leslie Cox. Steps were taken concerning the Mendes Prior fraud operation run from Thailand and as a result, Cox was arrested on passport charges traveling into Taiwan. On a number of occasions, negotiations were undertaken with Cox whilst in custody in Taiwan with a view to recovery for New Zealand victims. Part of the recovery negotiation process involved dealing with the Minister of Justice in Taiwan. The New Zealand Government assisted this process through the Hon. Peter Dunne who attended the meeting. Further steps with other victims were undertaken in South Africa, Hong Kong, London, Singapore and Malaysia.

Fraud Claimant Seeks Help in Higher Places — New Zealand Herald

DEREK TURNER FRaud

Derek Turner commenced his fraud operation in Australia before moving to the Bahamas. He ran an investment scheme promising high returns and was advanced to victims by a broking operation. New Zealand victims lost some NZD 2 million. Turner was eventually apprehended by an FBI undercover operation and is currently serving 20 years imprisonment in a US jail. Assets accumulated as a result of his fraud are still being liquidated with proceeds being distributed to victims.

-

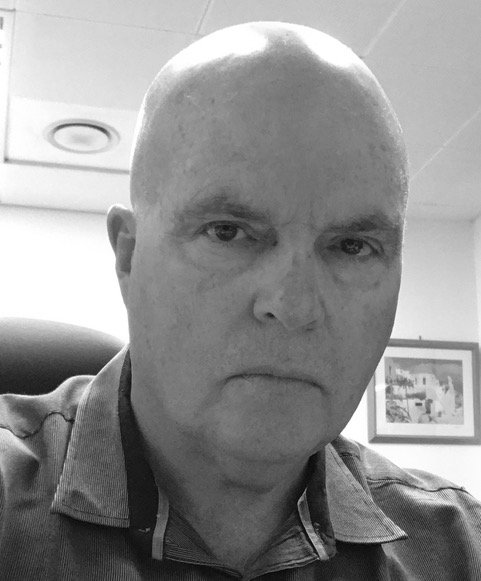

Mark van Leewarden

Founder & MD

Mark was deployed as an undercover agent at age 20. He quickly infiltrated an organized crime operation and became a running mate with one of New Zealand's most notorious criminals. Mark would go on to earn honours degree in Law before founding Warden Consulting in 1995. Working across all aspects of the business, he has traced, frozen and distributed stolen assets back to our clients in Asia, Europe and The Americas. He is enrolled as a barrister and solicitor of the High Court Of New Zealand and holds a practicing certificate as a barrister.

-

Ben van Leewarden

General Manager

Ben is a licensed private investigator with over eight years experience in international fraud, surveillance and undercover operations. Ben brings true international experience to the company having operated the business in Amsterdam, New York, London and Mexico City. He holds a Bachelor of Commerce (BCom) degree from Victoria University in Wellington.

-

Dennis Parsons

Consultant

Dennis is an expert forensic accountant, certified fraud examiner (USA), and licensed insolvency practitioner (NZ) who has undertaken hundreds of forensic accounting investigations of companies and individuals in both civil and criminal cases. He provides expert advice and consultation services to a number of government agencies in relation to civil and criminal investigations and related regulatory matters.

-

Pablo Rivera

Legal Counsel

Pablo holds a masters degree in Law (LL.M.) from La Universidad Nacional Autónoma de México (UNAM). A specialist in corporate law he has worked for Google, Baker Hughes, McDonalds and Jaguar. He assists on financial crime cases and provides specialised legal investigation advice from our Mexico City office.

-

Andrea Tomba

Consultant

Andrea holds a BA (Hons) in Business Studies from the University of Westminster. He is fluent in Italian, French, Swedish, English, and Spanish. He has lived in Mexico for the last 25 years. Andrea's diverse skill set and global perspective are key assets for international cases.

-

Ainsley Bisset

Operations

Ainsley ("Ladybird"), started her career in the Police. She was a member of the Diplomatic Protection Squad, protecting high profile dignitaries and politicians including Princess Diana. Ainsley oversees all major fraud cases, conducting research and organizing backend logistics. She has HR responsibility including the protection and care of Warden undercover agents.

-

Denise Graham

Office Manager

Denise ("Diesel") is our Office Manager and has been with Warden since 2006. She manages each and every detail of our day-to-day business. Diesel came to us following a long and varied career in the legal sectors, commencing work at the Magistrates Court in Auckland and subsequently working for Barristers, Queen’s Counsel and law firms in New Zealand, Australia and the UK.

-

Warden’s Network

International Associates

Our international team of lawyers, forensic accountants, investigators, finance executives, covert agents and government agency officials work together to deliver the most desirable outcome.

Ready to resolve your issue?

Learn More About Warden

Financial Crimes we investigate

Accounting Fraud:

Cooking the Books: Falsifying financial statements or records to overstate revenues, understate expenses, or manipulate earnings. Revenue Recognition Fraud: Recognizing revenue prematurely or falsely to boost financial performance. Expense Fraud: Overstating expenses or creating fictitious expenses to reduce taxable income.

Embezzlement:

Misappropriation of Funds: Illegally diverting funds or assets for personal use. Payroll Fraud: Manipulating payroll records to siphon money from the company.

Securities Fraud:

Insider Trading: Buying or selling securities based on non-public, material information. Pump and Dump: Inflating the price of a stock through false or misleading statements and then selling off shares at the higher price.

Identity Theft:

Credit Card Fraud: Unauthorized use of someone else's credit card or card information. Phishing: Deceptive emails or websites used to collect personal and financial information.

Money Laundering:

Layering: Creating complex financial transactions to obscure the source of illegal funds. Integration: Funneling "clean" money into legitimate businesses to legitimize illicit gains.

Ponzi Schemes:

High-pressure sales tactic employed by brokers or salespeople who use aggressive and misleading tactics to convince potential investors to purchase overvalued or non-existent securities. These schemes attract investors by promising high returns but using funds from new investors to pay returns to earlier investors.

Corporate Espionage:

Illegally obtaining sensitive information, trade secrets, or intellectual property from other companies for competitive advantage.

Insurance Fraud:

Staging accidents or filing false insurance claims to collect payouts. Premium diversion by agents or employees.

Warden Consulting Fraud Investigation Process

Our investigators plan, adapt and execute:

Assemble victim group(s)

Depending on the size and nature of the fraud it may be preferable to form a victim group in order to combine resources and share information about the offender(s).

Gather Information

The key step in any financial investigation is to collect evidence. We start by receiving and analysing initial information, including financial records, documents, and witness statements. We also conduct extensive background checks on targets. Information is gathered from company registers, bank accounts, credit cards, property titles, surveillance and digital profiles. This helps us establish a solid foundation for our investigation and identify potential red flags.

In-Depth Analysis

Leveraging our law enforcement experience and expertise, we conduct thorough analyses of financial transactions and data to find targets, uncover irregularities, patterns, and discrepancies.

Trace offenders

We use a variety of tracing methods, utilising traditional, digital and covert methods. By following the money we begin to paint a picture of the fraudsters' operation.

Collaboration with Experts

The case can be strengthened by pooling our resources with experts. We collaborate with forensic accountants, legal experts, cybersecurity professionals, and other specialists to enhance our investigation.

Conduct interviews

At this point we may conduct interviews with the offenders. Our law enforcement and legal background allows us to pressure the offenders, who may return the funds to our clients in order to avoid jail time or further investigation.

Reporting and Legal Action

Our team compiles detailed reports presenting our findings, analysis, and recommendations. These reports serve as crucial evidence in legal proceedings, supporting law enforcement agencies and legal professionals in taking appropriate action against fraudsters.

Freezing Bank Accounts and Seizing Assets

We obtain court orders based on the evidence gathered throughout the case. The next step is to liaise with financial institutions to trigger the freeze of specified accounts. We also coordinate with law enforcement to seize physical assets such as property or vehicles. We may oversee civil litigation and push to ensure that the proceeds of all assets will be distributed to our clients.

Distribution of Assets

If the case enters the legal system our main main focus is to secure a court issued judgement that will direct funds back to clients. We push to create a distribution plan that outlines how the recovered funds will be allocated among our clients. The plan includes factors such as proportioning the share of each client's claim and other legal considerations. We then disburse payments through our forensic accountant for security and transparency.

Certified fraud Examiner CFE

Certified Fraud Examiners ACFE

Warden Consulting has been a certified member of CFE and ACFE since 2001 and American Society of Industrial Security (ASIS). We fight for criminal justice and fraud prevention.